7

• improvements to your billing systems and record keeping

system, or a general review of your current systems to

improve profitability and cash flow

• national insurance efficiency and employee remuneration.

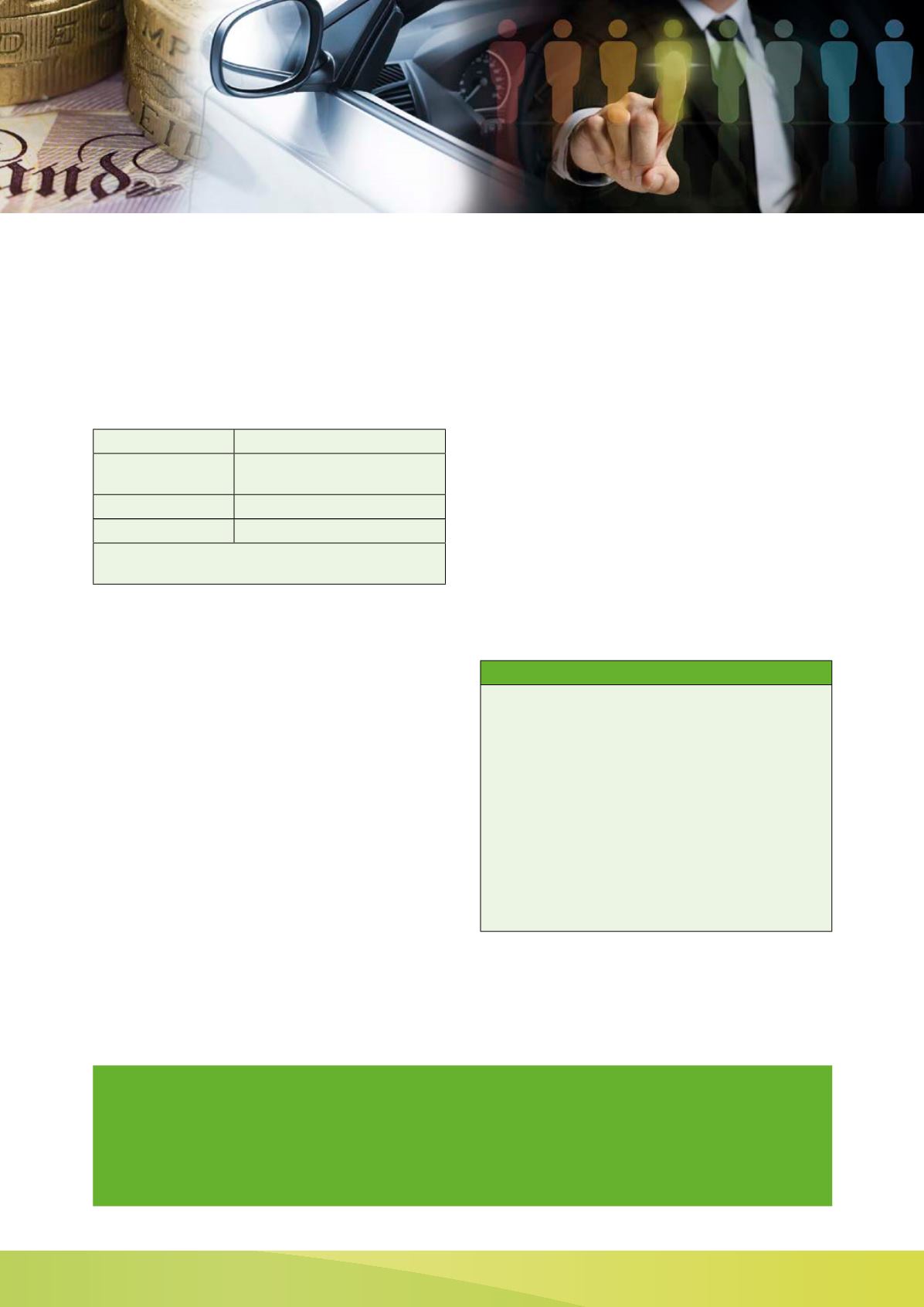

Avoiding late filing penalties

It is important to keep your tax affairs in order so that you avoid

incurring any late filing penalties. The cut-off dates are shown in

the calendar, but the current penalties are:

Return one day late

£100

Return 3 months late An additional £10 for each following

day up to 90 days

Return 6 months late Add £300 or 5% of the tax due

Return one year late Add £300 or 5% of the tax due*

*In more serious cases, this penalty may be increased to 100%

of the tax due.

The timetable for making tax payments is relatively

straightforward for the self-employed:

• 31 January in the tax year, first payment on account

• 31 July after the tax year, second payment on account

• 31 January after the tax year, balancing payment.

Again, a system of interest and penalties applies. For example,

if any balance of tax due for 2015/16 is not paid within 30

days after 31 January 2017, HMRC will add a 5% late payment

penalty as well as the interest that will be charged from

1 February 2017.

A further 5% penalty will be added to any 2015/16 tax unpaid

after 31 July 2017, with a final 5% penalty added to any

2015/16 tax still unpaid after 31 January 2018. Interest is also

charged on outstanding penalties, as well as on unpaid tax

and NICs.

If your business is incorporated, it will be liable to corporation

tax. Corporation tax is usually payable nine months and one day

after the end of the company’s accounting period.

If there are cash flow issues, HMRC might be persuaded to

accept a spreading of your next business tax payment – you

will have to pay interest at the HMRC rate, but keep to the

agreed schedule and late payment penalties will be waived.

Arrangements need to be put in place before the due date for

paying the tax, so talk to us in good time if you wish to apply.

Payments on account

Payments on account are normally equal to 50% of the

previous year’s net liability. A claim can be made to reduce your

payments on account, if appropriate, although interest will be

charged if your actual liability is more than the reduced amount

paid on account.

There is no equivalent mechanism to make increased payments

on account when the year’s tax will be higher, so you should

ensure that you build a reserve of money to pay the balance of

tax due.

Don’t wait until it’s too late if you have difficulties!

Please tell us in good time about any issues facing your

business, as we may be able to offer solutions.

Payments on account are not due where the relevant amount

is less than £1,000 or if more than 80% of the total tax liability

is met by income tax deducted at source. In these cases, the

balance of tax due for the year, including capital gains tax, is

payable on the 31 January following the end of the tax year.

Case Study

Raul is self-employed. His accounts are made up to 31 August

each year. When we prepare the 2016 Return we will be

including his profit for the year ended 31 August 2015, and

that is the profit which will be taxed for 2015/16.

Raul’s payments on account for 2016/17 will automatically be

based on the 2015/16 liability.

Providing we know that Raul’s profits for the year to

31 August 2016 are significantly less than the previous

year, we can examine the figures, perhaps even prepare the

annual accounts and, taking into account any other sources

of taxable income, make a claim to reduce Raul’s 2016/17

payments on account, easing his cash flow by reducing the

tax payments due in January and July 2017.

Your next steps: contact us to discuss…

•

Starting up a new business

•

Raising finance for your venture

•

Timing capital and revenue expenditure to maximum

tax advantage

•

Minimising employer and employee NIC costs

•

Improving profitability and developing a plan for

tax-efficient profit extraction